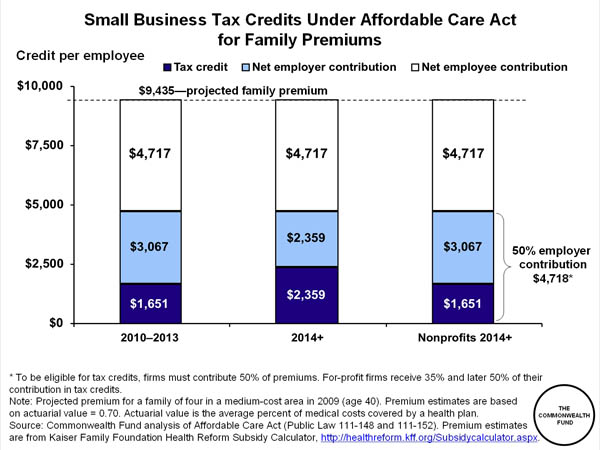

If you run a small business or a nonprofit, you won’t have to start providing insurance to your employees, but the new law makes it more affordable to. By 2014, tax credits for providing health insurance will increase to 35% for nonprofits and 50% for small businesses of 35 employees or fewer.

ADDITIONAL INFORMATION:

- “Small Business Health Care Tax Credit for Small Employers” from irs.gov

- “How are Small Businesses Affected by Health Reform?” from the Kaiser Family Foundation (scroll down to the “Employers” section)

- A page on health reform from the US Small Business Administration

- Info on the SHOP Marketplace from healthcare.gov